5 Tips For A Happy Financial New Year

Have you made your New Year Resolutions yet? One smart resolution is to budget for the new year. It will help you look at your finances and get on the right track for your spending during the upcoming year. Did you know the Capital One Venture Card can help you track your spending? This was a convenient feature for me while shopping for the holidays. While everyone loves spending on friends and family, it’s important to stay on track with savings and financial goals during the busy holiday season, so they can start the New Year off on the right foot. I used the Capital One Wallet App (for download in the App store on your smartphone) to help me track my spending when I was buying Christmas presents. Capital One offers straightforward, intuitive products and tools to help consumers use their money wisely during the holiday season and beyond.

It’s Happy Holidays or Bust! Here are 5 tips for a Happy Financial New Year:

1. Make a Budget For the Year

At the beginning of the year, I like to sit down for a few minutes and look ahead at my bills for the year. I use a printed spreadsheet to keep track of my monthly bills to see exactly what my fixed expenses are. I look at this printout to see how much I will be having to spend, then look at my “free” money to see how I can manage it better. My “free” money is the money left over after all the necessary bills are paid. I spend my “free” money on gas, groceries, weekend activities, you name it.

The Capital One Wallet App for your smartphone helps you track your spending. Since I have a Capital One credit card, I use my account to keep track of my spending. When you sign in to the App it displays a snapshot of your card with your balance and activity. This is a handy feature because I can instantly see how close I’m getting to my balance limit I set for myself each month.

2. Analyze Your Monthly Bills

The majority of our bills like power, water and gas have fixed rates that we have to pay. But, for your bills like satellite tv or cable, phone, or internet, you can analyze those and see if you really need them. If you’re on a budget and need to save some money, look at those flexible monthly bills. A few years ago I was paying for the most expensive satellite tv service, had a cell phone and a regular house phone and the fastest internet. My money was tight and I didn’t have much to spend on other things. I made a few changes by switching my satellite tv service to one that had less channels. I had a cell phone, so I cancelled my home phone. I reduced my internet service speed. By making these changes, I saved $200 a month!

You can use your Capital One credit card to pay your bills. It will free up your cash flow for a few days or weeks until your credit card bill is due. Plus, if you write checks for your bills, it will eliminate using checks, which is essentially another cost, thus saving you more money!

3. Create an Emergency Fund

Have you ever had something to happen like having to buy a new set of tires, your washing machine quitting or your daughter needing a cheerleading uniform that you hadn’t planned on buying? If you have an emergency fund, you can depend on it for paying for those unplanned events. By setting aside as little as $20 a week, you can have hundreds of dollars saved up for your emergency fund, to use it when you need it!

4. Take Your Lunch To Work

Did you know you can have more “free” money by taking your lunch to work and not eating out? By bringing a lunch to work, I save on average $8 per meal. Yes, you do spend money at the grocery store, but essentially you are buying in bulk at the grocery store (a loaf of bread, a pack of lunchmeat, a pack of lettuce, etc. in which there are many servings. You can save on average about $25 per week by bringing your lunch to work.

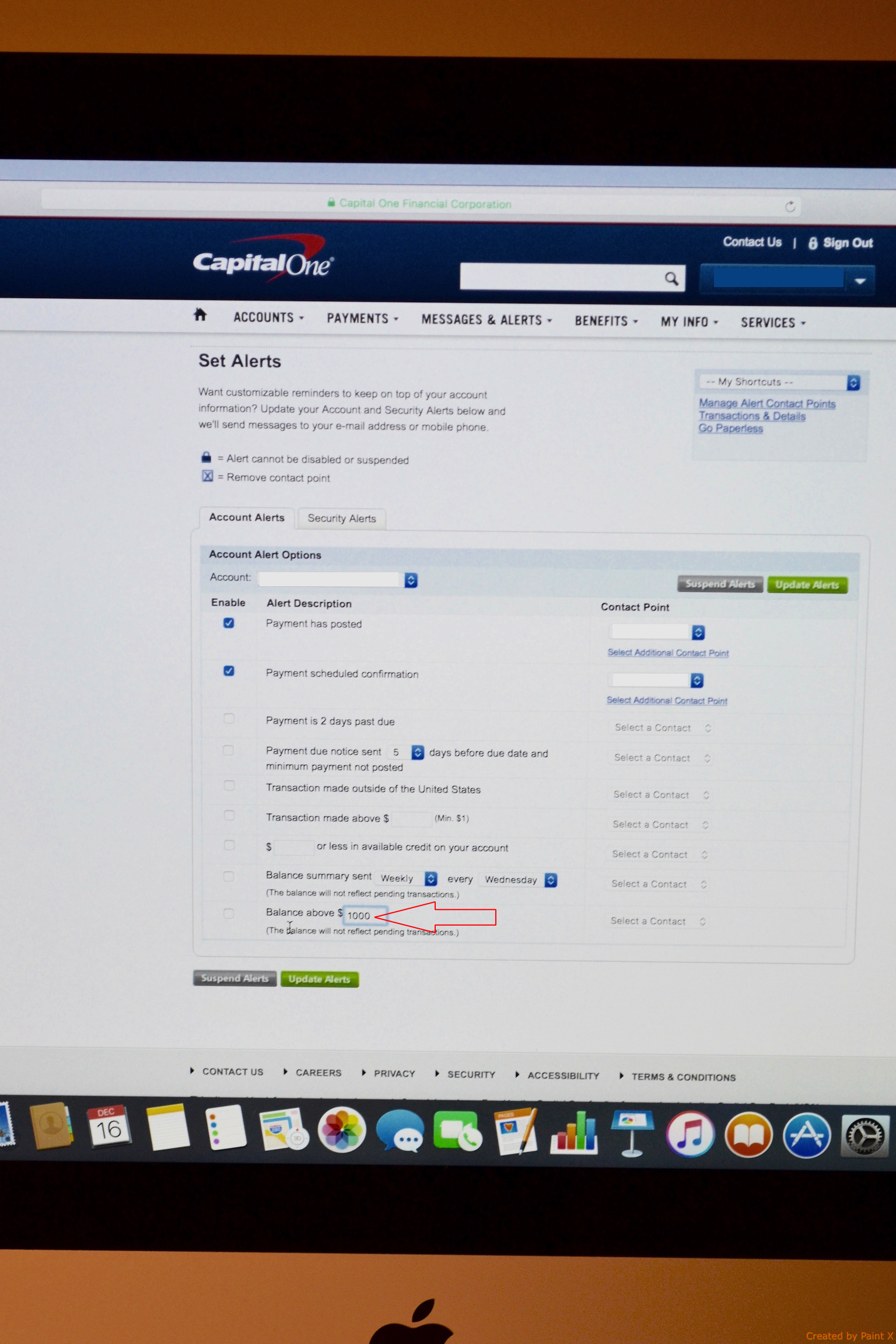

5. Set Spending Limits for Luxury Items

A good rule of thumb to buy luxury items is ask yourself, “Do I really want or need this item?” A good way to test and see if you really want it, is to wait about a few weeks before you buy it. We overspend by buying an item on impulse. Step back and ask if you really need it or want it. After you wait a few weeks you still want it, then see if your budget will allow it, then buy it.

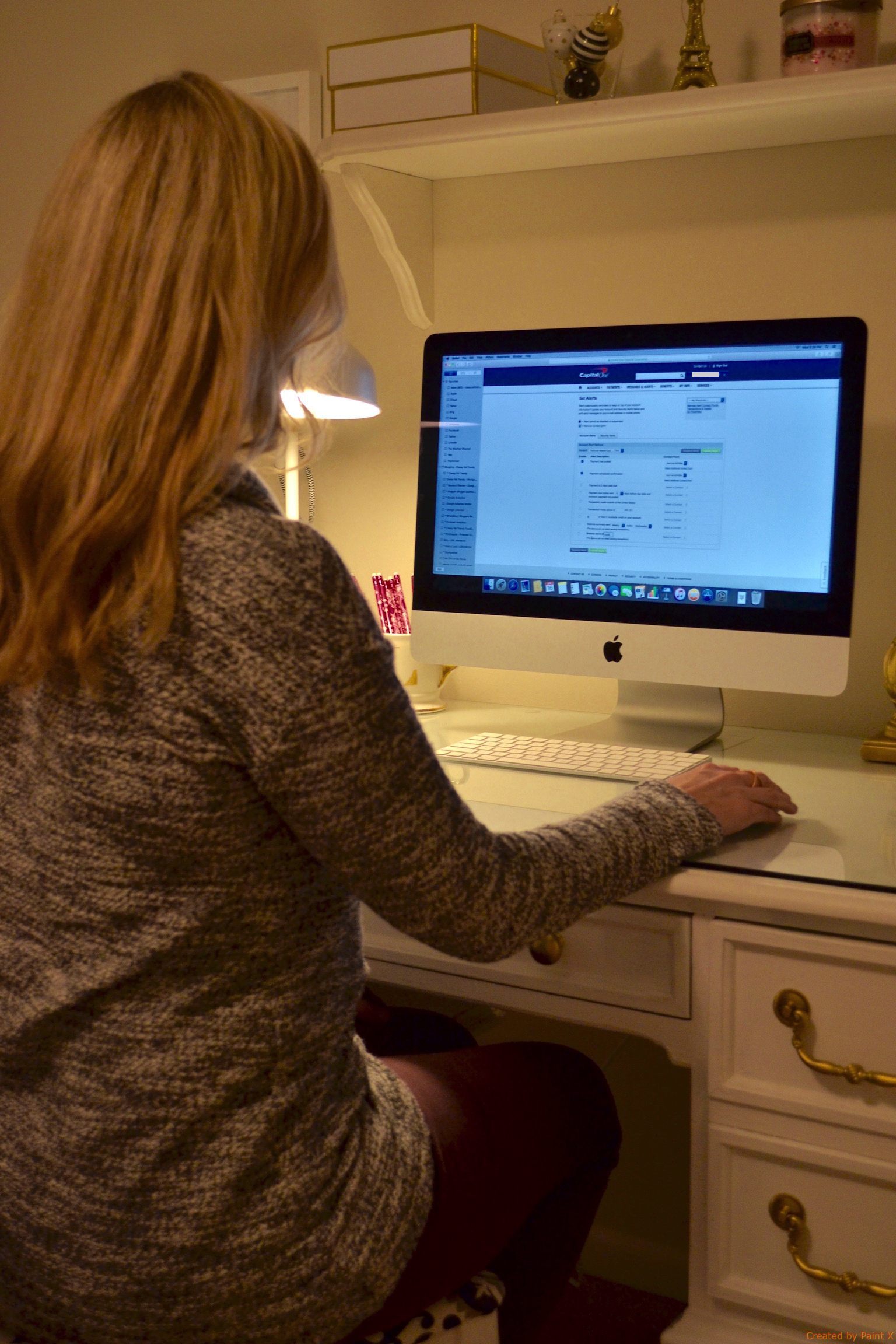

A handy feature on your Capital One account: You can set a spending limit notification online on your Capital One Account (see below for screen shot). If you’re out shopping and you’ve reached your budget, you will receive a notification. How cool is that?

Also, buy your luxury items at the end of the month, or after all the usual bills are paid. Before you buy any luxury items, use your Capital One Wallet App to see if you’ve reached your budget for the month. If not, go ahead and buy it!

It’s easy to set a budget and track your spending by using Capital One. The Capital One Venture Card can help you do just that!

I was selected for this opportunity as a member of Clever Girls and the content and opinions expressed here are all my own.

One Comment